The U.S. stock market reached new highs to close out 2017. The S&P 500 stock index was up over 21% last year and already another 6% in January before experiencing some decline in February. Given that the long term average return for the stock market is around 10%, future price appreciation is likely to be much lower. Not to mention that the market has not had a significant drop in almost a year and a half – far from the norm.

As our last commentary detailed, there are numerous indications that stocks are overpriced and vulnerable to substantial losses. The recent acceleration in prices seems increasingly to be the result of speculative fervor (i.e., gambling) rather than a reflection of sound investing principles.

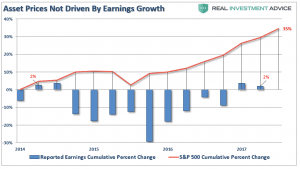

As the accompanying chart demonstrates, corporate earnings are not much changed from 2014.

“Since 2014, the stock market has risen (capital appreciation only) by 35% while reported earnings growth has risen a whopping 2%. A 2% growth in earnings over the last 3 years hardly justifies a 33% premium over earnings.” – Doug Kass

The recent steepness of the market’s climb, on top of already high valuations, is reminiscent of previous investment bubbles. Nearly vertical increases in prices are almost always followed eventually by nearly vertical drops.

Speaking of investment bubbles, Bitcoin, the newly popular cryptocurrency, appears to be the latest example of “irrational exuberance.”

“It’s absolutely critical to distinguish the long-term effects of valuation from the shorter-term effects of speculative pressure. Historically-reliable valuation measures are remarkably useful in projecting long-term and full-cycle outcomes, but the behavior of the market over shorter segments of the market cycle is driven by the psychological inclination of investors toward speculation or risk-aversion.” – John Hussman, Hussman Funds

In other words, markets can become irrational (and very risky) in the short run but are ultimately rational in the long run. We are in one of those irrational periods and we continue to err on the side of caution with your investments.