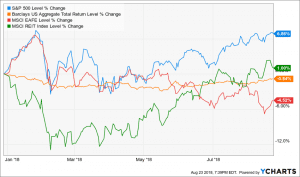

Year to date, US stocks (S & P 500) are up a little under 7%, Real Estate Investment Trusts are up 1%, while US bonds and international stocks are down .84% and 4.52% respectively.

YTD

The American economy seems to be holding up well as evidenced by much higher corporate profits and lower unemployment. However, the price of many stocks is still elevated and have gotten ahead of earnings. What is more, there are a number of potential concerns lurking ahead including:

- Possible trade wars that could lead to slower economic growth

- Increasing inflation

- Increasing interest rates – the Federal Reserve is currently forecasting up to two more rate increases this year and at least that many in 2019

- Can earnings continue to grow at a good rate without the extra “juice” provided by the one-time benefit of a major tax cut?

- Slowing growth in Europe and Asia

How these issues play out will have a lot to do with investment performance going forward.

We believe active investment management will be more important in such a volatile environment. Whatever environment we encounter we will continue to take a disciplined approach to managing your portfolio, targeting undervalued investments when available and utilizing alternative investments such as real estate, convertible bonds, and floating rate securities that seem likely to provide good risk adjusted returns.