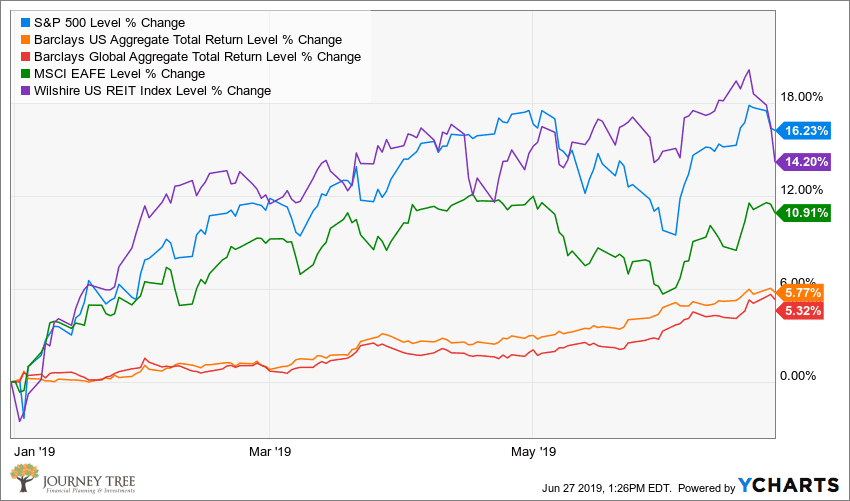

As of June 26th, all the major indices were up for the year-to-date (YTD), but while Q1 was overwhelmingly positive for all the asset classes, volatility and uncertainty have returned in May and thus far in June. In fact, the only consistent upward trajectory, in terms of price, has been experienced by the two bond indices, U.S. and Global.

The stock market had a strong reaction in May to:

- Brexit – Theresa May indicated at the end of May that she is stepping down as U.K. Prime Minister and No Deal Brexit continued to put downward pressure on both European and U.S. stocks.

- In the U.S., trade negotiation related volatility added more fuel to an already uncertain environment.

- The Federal Reserve, pointing to trade uncertainty and global growth issues, signaled that the Fed may be open to cutting rates. While the markets have interpreted this news favorably, this is a quite a shift from the policy of raising rates in 2018, then in March of 2019 indicating no need to raise rates, to finally indicating, in the June meeting, that they are open to cutting rates.

0