A widely held belief in both academia and the investment industry is that a person should have as much of their money in stocks as they can tolerate because stocks have provided the highest returns over long periods of time. Most people cannot handle the erratic volatility of an all stock portfolio so many advisors say “let’s do 60% in stocks and 40% in bonds” in order to make things a bit more palatable.

“60/40” has come to be the conventional approach in investing. It is based on the idea that you put the majority of your money into stocks in order to take advantage of their historically higher returns. Then you put the rest into bonds to provide some income and lower volatility. This allows bonds to have a stabilizing influence on your portfolio.

“60/40” is easy for advisors to implement. They can “set it and forget it.” They tell clients that it is best to keep that ratio no matter what and if stocks decline substantially (and their account with it) they just need to hang in there and not sell out of fear. They also often claim that it is not wise to try to “time” the market by changing the allocation. They say no one knows what markets are going to do and therefore you shouldn’t try to adjust your investment allocation because you might miss out on gains.

There is some value in recommending this kind of diversification but it has major disadvantages and we think it is particularly ill-suited for our current investment environment.

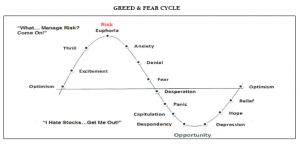

While it is often cited that stocks have averaged around a 10% annual return over long periods of time, returns fluctuate wildly from year to year based on the “Greed and Fear” cycle.

When investors are excited and are eager to make money, they bid up the prices of stocks which tends to create “bubbles” of overvaluation. Inevitably, those bubbles pop when investors become fearful and run away from stocks. Isn’t it strange that Investors get more interested in buying stocks as their prices rise, but with everything else they buy, they love getting a discount?

Another problem with the 60/40 approach is that the long-term stock returns mentioned are typically from periods of 50 years or more, far greater than the investment horizon for most investors. While stocks may return 10% over 50 years they may fall far short of that for the next 10-15 years of a person’s retirement. Having too much money in stocks at high points in the stock market can be devastating to portfolios that are providing crucial retirement income.

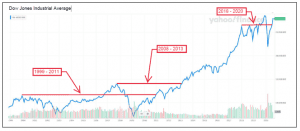

Let’s say that an investor has 60% of their retirement account in stocks at the high point in the market in 1999. In 2000 the “internet bubble” burst and stocks declined substantially over the next 3 years. The value of investor’s stocks would have been below the 1999 peak until late 2006 – almost 7 years of no appreciation in the value of their stocks. To make matters worse, after some gains in 2007 and part of 2008 stocks dropped about 50% by March of 2009 due to the “housing bubble’s” impact on the stock market.

The investor would likely have seen their portfolio decline around 30% during that period not getting back to the 2008 market high until 2013. That seems to be an awfully long time for your stocks to not increase in value.

To minimize these risks JourneyTree employs an investing strategy that seeks to determine whether various types of investments are relatively expensive or relatively inexpensive and make appropriate investment allocations accordingly. We will elaborate on this approach in a future commentary.