Over the last several years leading up to 2022 the acronym TINA was a very popular description for investment strategy. TINA stands for There is No Alternative (to stocks). The belief was that, with the Federal Reserve keeping interest rates at 0% and rushing to bail out the stock market each time it was in danger of declining significantly, stocks were the only place one could make any money. Certificates of deposit, government bonds, and money markets all offered extremely low rates which forced investors to take on more risk than they wanted in an attempt to make a decent return.

To us, TINA was always a risky strategy. Investing in overpriced stocks just because they kept going up was a dangerous approach given the large losses that eventually occur when stocks go too high as we saw in 2000-2002 and 2007-2009 when stocks dropped over 50% from overvalued levels. Indeed, stocks dropped as much as 30% earlier this year before bouncing back a bit. Although we have had a respite from the relentlessly negative markets of the first half of the year, we think there is a strong possibility of more declines ahead as interest rates continue to rise to bring down inflation. Don’t be lulled to sleep when the market is quiet.

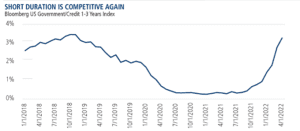

There is a new acronym on the scene (courtesy of Calamos funds whose Market Neutral Income fund we use) and her name is CINDY (Credit Is Now Delivering Yield). In other words, bonds, CDs, and the like are starting to pay attractive interest rates, offering a lower-risk alternative to stocks.

For example, six-month treasury bills are now paying 3.08% interest which is 3.05% MORE than 1 year ago. This has been traditionally about as safe of an investment as you can get since it is truly short term and backed by the Federal government. This rise in rates has been echoed in other income investments we use. Here’s a sampling:

- JPMorgan Ultra-Short Income 2.50%

- T Rowe Price Ultra Short-Term Bond 3.78%

- Performance Trust Strategic Bond 5.08%

- T. Rowe Price Floating Rate 6.28%

- PGIM High Yield 7.74%

With potential for more interest rate hikes by the Federal Reserve and the distinct possibility of a recession resulting from those increases, stocks could face stiff headwinds for some time. Finally, we have some solid options with both a better chance of preserving capital and providing a relatively high level of income while we wait for attractive long-term opportunities in the stock market.