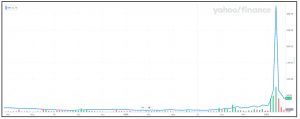

GameStop Corp (GME) Feb 20, 2019 – Feb 19, 2021

The dramatic rise in the price of GameStop Corp. stock took the nation by storm in January. Beginning 2021 at a price of less than $20 a share it exploded to almost $350 by January 27. What accounted for the more than 1,500% increase? A frenzy of speculation (or gambling if you prefer).

An unprecedented mixture of neophyte retail investors, newly available free trading, hedge funds shorting (betting against) overpriced GameStop shares then having to buy them back as the price continued to skyrocket, social media pundits galvanizing interest in GameStop and against the hedge funds, and investors with time on their hands and stimulus money in their pockets led to this phenomenon.

But here’s the thing – there is no rational case to be made for GameStop as a wise investment. These speculators/gamblers did not bother to analyze whether the company was making money or had strong finances. Otherwise, they would have discovered that GameStop has been losing money in recent years and were projected to lose money in the next few years. They placed their bets in hopes of making a bundle and teaching the hedge funds a lesson.

Undoubtedly, a handful of investors made a lot of money on GameStop’s rise but many more have lost most of the money they put into the stock with the price now back down to about $40 a share. How would you feel if you bought shares for $300 then saw them drop almost 90% in the next 3 weeks?! More like a trip to the casino than a smart investment.

Investopedia website states:

“Speculating is the act of putting money into financial endeavors with a high probability of failure. Investors hope to generate income or profit through a satisfactory return on their capital by taking on an average or below-average amount of risk.”

GameStop is but one example of speculation that is now rampant in many sectors of the markets. At times like these where aggressive risk taking is popular it is crucial to remember that long term financial success lies in being selective in your investments, patient, and attentive to risks you should avoid.