Caution Ahead

“The question you should be asking yourself is, ‘Is it a good time to take more risk or less risk?’”

-Howard Marks, Oaktree Capital

This question is constantly on our minds at JourneyTree. Given what we know about the economy and the performance of various investments how should we prepare our clients for the future?

After a record-long economic expansion and bull market in U.S. stocks, it would be natural for many to be complacent and expect the good times to keep on rolling. There is a tendency to believe that what has been happening will keep on happening.

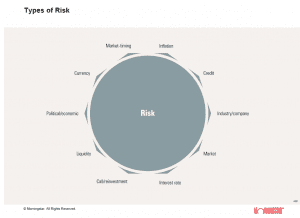

As indicated in the graph above, there are a wide range of risks that your friends at JourneyTree are continually evaluating. We do not try to forecast the direction of the economy or the markets. However, we do attempt to assess whether risks are low or elevated and make informed investment decisions accordingly.

There are a number of reasons that we believe risks are very high and that caution is warranted:

- The U.S. stock market is near an all-time high

- We are currently in both the longest expansion and bull market in history

- Many indicators of stock values show this to be one of the most expensive markets of all time

- Investors are again putting money into start-up companies that are unlikely to justify their current sky-high prices

- Corporate earnings growth has slowed markedly

- Federal interest rate policy has kept rates extraordinarily low encouraging investors to take on more risk and artificially pushing stock prices higher

- There is a great deal of uncertainty surrounding trade and politics

Our task is to help you meet your financial goals with as little risk as possible. We put an emphasis on avoiding large losses but also want portfolios to be positioned to make a reasonable amount of money when the markets are positive.

This strategy has worked well over the last year and a half. In the fourth quarter of 2018 when the U.S. stock market was down almost 20% most of JourneyTree’s accounts were down just 4-6%. Yet in 2019 thus far most of those same accounts are up 9-12%.

We believe that a relatively low allocation to U.S. stocks, higher allocation to foreign stocks, maintaining substantial liquidity in short-term income funds, and focusing on value-oriented stock funds (which have been out of favor for a long time) will continue to serve our clients well. In addition, using a number of flexible funds that will buy more stocks when prices decline helps us protect accounts when the markets drop and to benefit from future market increases.