Market sentiment changed abruptly in February. After achieving a new all-time high on February 12, the Dow Jones Industrial Average declined just over 14% through February 28. The last week of February saw one of the largest weekly drops of the last 100 years. Given our defensive positioning most JourneyTree Accounts were down just 3-4% over that period.

After rising 35% from December 24, 2018 to the peak on February 12, “[. . .] the Dow at nearly 30,000 had been priced to perfection and was particularly vulnerable to any surprise … event,” stated money manager, Peter Schiff of Euro Pacific Capital.

“But the coronavirus … forced investors to confront risks that were actually lurking in plain sight the entire time. Even if the virus scenario plays out to be relatively benign, the short-term hit to businesses that are increasingly dependent on global supply chains, travel, tourism, and transportation will be showing up very quickly and may likely make a meaningful impact on quarterly results. In a market priced as if nothing bad would ever happen, these questions are proving to be too much to bear,” Schiff explained.

The market’s vulnerability stems from the fact that some eleven years after the financial crisis the U.S. economy is not that strong. Even though unemployment, by some measures, is at all-time lows, economic and corporate earnings growth have been anemic despite extraordinarily low interest rates.

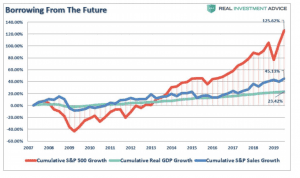

The chart below shows that while the U.S. stock market had risen nearly 125% since 2007, gross domestic profit (GDP) grew only 23%. In effect, investors have been willing to pay increasingly more for the same amount of earnings leading to what has been, by many indicators, one of the most overpriced markets in history.

Asked about this disconnect, economist David Rosenberg said, “It’s perfect symmetry. We have had $4 trillion of quantitative easing matched perfectly by $4 trillion of corporate buybacks… We have never before seen such a stock-market performance in the face of what has been in the last 11 years the weakest expansion of all time.”

In essence, the Federal Reserve has kept interest rates at historically low levels and added trillions of liquidity to the economy and the bulk of it enabled corporations to buy back trillions of dollars of their own stock. This has propelled the stock market to record levels without much economic growth to support it.

The coronavirus threatens those artificially high levels. At the moment, the market is rallying in the wake of an emergency ½ percent cut in interest rates by the Federal Reserve and election developments. However, these dramatic swings in market prices likely point to more volatility ahead. Furthermore, the total impact of the virus will not be known for weeks if not months and there is little that interest rate cuts can do to bring clarity to the situation.