“There really isn’t any doubt that financial markets remain broken and divorced from reality.”

– David Rosenberg

Rosenberg Research

Economic Research for Informed Investing

“Never before have I seen a market so highly valued in the face of overwhelming uncertainty…”

– James Montier

GMO Investments and Asset Management

Stock Prices

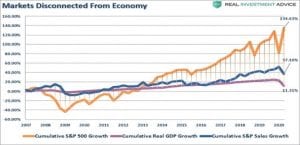

In early September the U.S. stock market (as measured by the S&P500) hit a new all-time high. Stock prices are now almost 11% higher than they were on January 1, this despite the weakest economy since the Great Depression. Why?

- Truly unprecedented fiscal stimulus from the Federal Government ($1,200 checks, higher unemployment benefits, PPP loans to businesses, etc.)

- Rock bottom interest rates and almost unlimited money printing by the Federal Reserve Board

- Excitement about a relative handful of large monopolistic technology companies (such as

- Facebook, Amazon, Google, and Microsoft) that has pushed them to astronomical prices vastly exceeding their improved earnings *

*This week the House of Representatives released a report recommending that the major technology companies be broken up because of their abuse of monopoly power.

- A wave of new investors who have never seen a prolonged down market and base their investment decisions not on thorough research but on what stocks are “hot” and the hype of internet pundits

- Free stock trading due to the elimination of commissions that has encouraged speculative trading

- The inability to make much money on money markets, CDs or bonds

- Expectations that a vaccine will arrive soon and “solve” the pandemic

Referring to the U.S. stock market, David Rosenberg goes on to say,

“it’s not just egregiously overpriced by any metric, but this has also become a market increasingly influenced by speculation, momentum, liquidity, and government manipulation.”

The COVID Economy

Efforts to control the pandemic as well as wary consumer behavior have had these impacts:

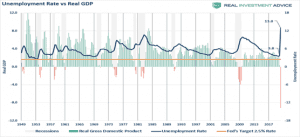

- A current unemployment level that is higher than at any time during the Financial Crisis

- Over a 32% drop in Gross Domestic Product (GDP) during the 2nd quarter and a likely decline of 4-5% for all of 2020

- A dramatic rise in bankruptcies – they increased 244% for the July-August period over a year ago

- Several entire industries such as sports, entertainment, airlines, restaurants, and travel have seen their revenues and profits drastically reduced

- Up to 40% of renters facing eviction notices in the coming months

- Mortgage defaults have increased 8.2% over last year

- The commercial real estate sector is under intense pressure due to working at home

Do these factors justify the lofty stock prices we have today?

For the stock market to remain at these elevated levels there must be substantial continuing government support and/or an effective vaccine(s) must be developed and widely distributed very soon.

Note: Pfizer, Inc., one of the world’s largest pharmaceutical companies just announced promising results from their trials for a coronavirus vaccine. However, it will still require FDA approval, possible by the end of the year, and take many months after that to distribute if approved.

Both of these actions remain highly uncertain. Great caution continues to be warranted.

“Ignoring the fundamentals is rarely a good strategy for the long term.”

– James Montier