With interest rates rising rapidly last autumn, calls for an imminent recession were widespread. But, here we are nearly a year later, and there are few signs of a temporary decrease in economic activity on the horizon.

Why Are We Not in a Recession Yet?

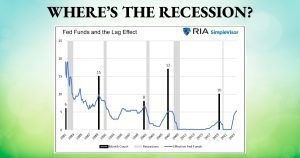

Expectations of a recession were everywhere roughly a year ago based on historical circumstances. In virtually every instance when short term rates have exceeded long term rates for a considerable period, a recession has followed in the next 12-18 months.

Interest rates began climbing last year in an effort to get raging inflation down to an acceptable level. The Federal Reserve’s primary tactic for combatting inflation is to raise interest rates. In the past, when rates got high enough, it slowed down economic activity. Layoffs increased and spending decreased until inflation came down to appropriate levels. Well, the economy has not slowed down much and layoffs have not occurred. It is often dangerous to say, “this time is different.” But this time apparently it is.

What Factors Have Boosted The Economy?

Unlike similar periods of continuously rising rates in the past, the current episode started at a time of an incredibly tight labor market and followed unprecedented government stimulus during the COVID pandemic. Other factors that have helped the economy hold up are:

-

- Consumers and corporations locking in historically low interest rates a few years ago such that recent increases haven’t affected them much … yet.

- Record government deficit spending that has increased economic growth.

- Significant wage increases obtained by workers in the tight labor market that has allowed consumers to keep up their spending.

Many pundits have suggested that with its approach to raising interest rates, the Federal Reserve may well be able to engineer a so-called “soft landing.” This means that it might do a perfect job of getting inflation under control without having the economy go into a recession.

Anything is possible. We may have a “soft landing.” Or, perhaps the effects of higher rates haven’t had time to set in yet. Time will tell.

TO GET THE LATEST FINANCIAL INSIGHTS …

FOLLOW OUR FACEBOOK PAGE

You may also enjoy: