Before last year started, roughly 85% of economists were confident that the U.S. would have a recession in 2023. We didn’t. It is still not clear if or when we will have one. Virtually every other time that interest rates have risen as much as they did in 2022 and 2023 a decline in economic growth has occurred.

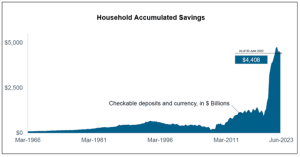

What was different this time? What many economists did not factor in was the size and impact of the unprecedented government stimulus during COVID (see graph to the right). That stimulus seems to have blunted the usual effect of much higher interest rates.

So, what happens this year? Who knows? We certainly could have a recession that may have just been delayed. We may have an economy that continues to grow.

The stock market rallied in the fourth quarter, apparently believing that there would be no recession causing stocks to continue to rise. The bond market, however, seems to believe that the economy will slow enough this year to cause interest rates to decline. Typically, this means that corporate profits will shrink because of the bad economy causing stocks to drop in price.

We believe it’s not possible to predict the course of the economy in 2024. It’s just too complicated. We don’t want to plan investment strategy based on what we think, or hope will happen. Our concern is to prepare client portfolios to be resilient during a range of possibilities. And this is an unusually uncertain moment.

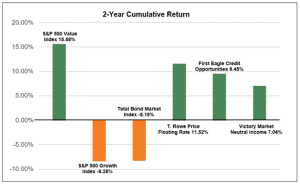

Given the late run up in the market last year, stocks are expensively priced – especially given the potential for recession and declining earnings. That said, value stocks (solid companies that are temporarily out of favor appear to be better bargains than growth stocks (popular fast-growing companies) that have gotten overpriced.

In addition to some value stocks, we are also storing cash in money market funds, treasury bills and other short-term bonds which currently pay in the range of 5-6% interest. Finally, our suite of alternative investments, such as floating rate bonds and private credit, has outperformed all other investments we track apart from value stocks. With high rates of interest and little downside exposure to interest rate changes we plan to maintain and perhaps expand our alternative investments.

We look forward to seeing what 2024 brings.

WHAT ARE NORMAL INTEREST RATES?

READ THIS ARTICLE

You might also enjoy: