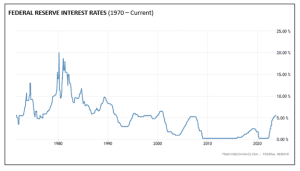

For the last 15 years since the Financial Crisis in 2008 interest rates as set by the Federal Reserve Board (Fed) have been at or near 0%. Home buyers got used to mortgage rates under 3% much of the time. Savers also, grudgingly, put up with paltry rates on their money market accounts, bond funds, and certificates of deposit.

Now that the Fed has increased their interest rate from 0% to over 5% to combat inflation, rates have risen in other parts of the economy. Mortgage rates have moved above 8%. Money market and CD rates have moved to 5% or more. Borrowers seem to feel that rates are now abnormally high, and savers are rejoicing that they can finally make a decent return on their money without taking greater risks in other investments like stocks.

This prompts the question, “what are normal interest rates?”

As you will note from the graph below, the current Fed rate is now close to the average rate over the last several decades. What was not normal were the historically low interest rates that people took for granted over much of the last 15 years. Conversely the Fed rate reached 20% in 1980 to extinguish out-of-control inflation during the 1970s. Somewhere in between seems like a reasonable place to be if unemployment and inflation are in good shape.

Of course, the direction of rates in the near term will depend on how successful the Fed is in bringing inflation down to its stated target of 2%. We are likely to find out in 2024.

WANT TO LEARN MORE ABOUT OUR INVESTMENT STRATEGY?

You might also enjoy: