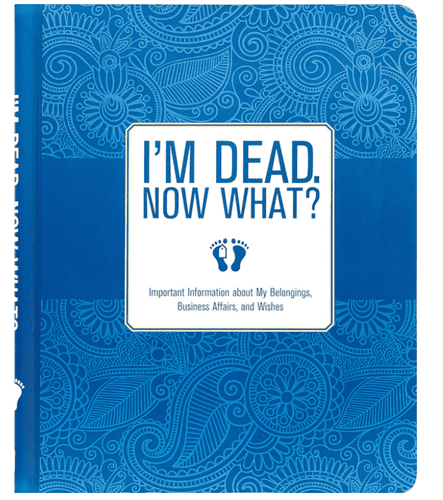

“I’M DEAD, NOW WHAT?” BY PETER PAUPER PRESS

The death of a loved one is emotional, stressful, and can put such a huge strain on those left behind. Why not be prepared for the inevitable? “I’m dead, Now What?” is an excellent workbook to help you prepare your loved ones for your passing. This book walks you through gathering all the information your loved ones will need to take care of your belongings, financial or business affairs, and your wishes. Instead of leaving them panicking or arguing over…